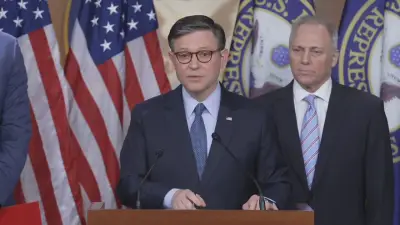

After meeting at the White House Speaker Johnson vows to push ahead on Trump’s big bill

WASHINGTON AP Defying opposition within his ranks House Speaker Mike Johnson insisted late Wednesday that Republicans would march ahead on their multitrillion-dollar tax breaks package after a lengthy White House meeting with GOP holdouts refusing to back the bill Johnson and his GOP leadership club appeared confident they would be able to stick to their schedule and shore up GOP help for final passage late Wednesday or Thursday following last-ditch talks to salvage the big beautiful bill But next policies are highly uncertain We re excited that we re going to land this airplane Johnson R-La revealed back at the Capitol But as evening hours set in the upbeat tone stood at odds with the unwieldy scene at the Capitol The Rules Committee has been grinding through a marathon session passing its th hour as the process chugs along Another Republican Tennessee Rep John Rose released his opposition to the GOP bill And Democrats without the votes to stop Trump s package are using all available tools and impassioned speeches to press their opposition and capitalize on the GOP disarray We believe it s one big ugly bill that s going to hurt the American people noted House Democratic leader Hakeem Jeffries of New York as he and his company testified before the committee Hurt children hurt families hurt veterans hurt seniors cut healthcare care cut nutritional assistance explode the debt he stated It s a make-or-break moment for the president and his party in Congress They have invested much of their political capital during the crucial first scarce months of Trump s return to the White House on this measure If the House Republicans fall in line with the president overcoming unified Democratic objections the measure would next go to the Senate Trump had implored the lawmakers a day earlier at the Capitol to get it done but the holdouts endured It s not at all clear what exactly was agreed to or not during Wednesday s lengthy meeting at the White House However Johnson indicated afterward that Trump himself may be able to accomplish by executive actions several of the goals that Congress is unable to agree to in the legislative process White House press secretary Karoline Leavitt declared the meeting was productive and moved the ball in the right direction One big dilemma has been the tentative deal with GOP lawmakers from New York and other high-tax states to boost deductions for local taxes to But that costly provision running into the hundreds of billions of dollars alarmed the most of conservative Republicans worried it will add to the nation s trillion debt For every faction of the slim House majority that Johnson appeases he risks losing others Rep Andy Harris R-Md the chairman of the hard-right House Freedom Caucus stated earlier he did not believe the package could pass in a House vote but there is a pathway forward that we can see A fresh analysis from the Congressional Budget Office explained the tax provisions would increase federal deficits by trillion over the decade while the changes to Medicaid food stamps and other services would tally trillion in reduced spending The lowest-income households in the U S would see their support drop while the highest ones would see a boost the CBO revealed At its core the package is centered on extending the tax breaks approved during Trump s first term in while adding new ones he campaigned on during his campaign To make up for certain of the lost revenue the Republicans are focused on spending cuts to federal safety net programs and a massive rollback of green resource tax breaks from the Biden-era Inflation Reduction Act Additionally the package tacks on billion in new spending with about billion going to the Pentagon including for the president s new Golden Dome defense shield and the rest for Trump s mass deportation and limit assurance agenda The package title carries Trump s own words the One Big Beautiful Bill Act As Trump promised voters the package proposes there would be no taxes on tips for certain workers including those in a few utility industries automobile loan interest or various overtime pay There would be an increase to the standard income tax deduction to for joint filers and a boost to the child tax credit to There would be an enhanced deduction of for older adults of certain income levels to help defray taxes on Social Safeguard income To cut spending the package would impose new work requirements for countless people who receive robustness care through Medicaid Able-bodied adults without dependents would need to fulfill hours a month on a job or in other public programs Similarly those who receive food stamps through the Supplemental Nutritional Assistance Operation known as SNAP would also face new work requirements Older Americans up to age rather than who are able-bodied and without dependents would need to work or engage in the public programs for hours a month Additionally particular parents of children older than years old would need to fulfill the work requirements under current law the requirement comes after children are Republicans revealed they want to root out waste fraud and abuse in the federal programs The Congressional Budget Office has estimated million fewer people would have wellbeing insurance with the various changes to Medicaid and the Affordable Care Act It also noted million fewer people each month would have SNAP benefits Conservatives are insisting on quicker steeper cuts to federal programs to offset the costs of the trillions of dollars in lost tax revenue GOP leaders have sped up the start date of the Medicaid work requirements from to At the same time more moderate and centrist lawmakers are wary of the changes to Medicaid that could end in lost healthcare care for their constituents Others are worried the phaseout of the renewable vitality tax breaks will impede businesses using them to invest in green power projects in a great number of states Plus those lawmakers from New York California and other high-tax states craved a bigger state and local tax deduction called SALT for their voters back home Under the emerging SALT deal the deduction cap would quadruple to with an income limit of according to a person granted anonymity to discuss the private talks The cap would phase down for incomes above that level The Committee for a Responsible Federal Budget a nonpartisan fiscal watchdog group estimates that the House bill is shaping up to add roughly trillion to the debt over the next decade